accounting services tax deductible

Expenses are not prohibited from. RMJR Tax and Accounting 14 Nassau Street Princeton NJ 08542 609 436-9500.

Business Related Meals Accounting Services Springfield Missouri

Generally tax prep fees are no longer deductible for most people.

. The HMRC allows companies to claim a tax deduction for some fees that your accountant charges. IR-2022-182 October 18 2022 The Internal Revenue Service today announced the tax year 2023 annual inflation adjustments for more than 60 tax provisions including the. Telephone and utility costs legal and.

Call us at 973-699-3872 now. Job in Princeton - Mercer County - NJ New Jersey - USA 08540. The Uniformed Services Former Spouse Protection Act defines.

Legal and accounting fees that you pay to start a business are deductible only as business start-up expenses. Are accounting services tax deductible. IRS provides tax inflation adjustments for tax year 2021.

WASHINGTON The Internal Revenue Service today announced the tax year 2021 annual inflation adjustments for more than. Accounting expenses auditing expenses and bookkeeping expenses are all deductible business expenses. The short answer to this is yes.

5 Accounting Services That Are Tax Deductible. 5 accounting services that are tax deductible. Startup legal fees could be for helping you review contracts hire executives or travel to negotiate purchase of a business.

Let JLD Tax Accounting make your tax. Medical services such as doctors dentists chiropractors acupuncturists and physical therapists focus on the well-being of patients. 395 Pleasant Valley Way.

However please bear in mind that due. Former Spouse Deductions. You can find out more.

West Orange NJ 07052. 5 Accounting Services That Are Tax Deductible. 6 September 2021 5 mins Accountants.

Are accounting services tax deductible. The retiree is not liable for taxes on payments made to their former spouse. However you can get preparation fees deductions if you operate your own business.

Accountants offer a wide range of services to businesses with most if not all. Expenses are revenue and not capital in nature. Up to 25 cash back Starting a Business.

You can deduct 5000 of start-up. Expenses are not a contingent liability. Professional services like Xendoo are 100 tax deductible.

Accounting Services Tax Deductible. Tax deductible expenses are almost any ordinary necessary and reasonable expenses that help to earn business income. Here is a more detailed list of.

Accounting costs for your business can be claimed as a business expense. Were constantly designing new tax planning techniques to decrease tax liabilities for business and individual taxpayers in all tax brackets. For business owners this means you.

An expenditure is considered to be tax deductible when it can be subtracted from the adjusted gross income line item on a tax return thereby reducing the amount of income. For the most part yes. For example a 139 plan may help employers retain their current employees by providing them with tax-free funds to help cover additional expenses incurred as a result of the.

Expenses are solely incurred in the production of income.

Damawa Tax Accounting Services Llc Damawataxasllc Twitter

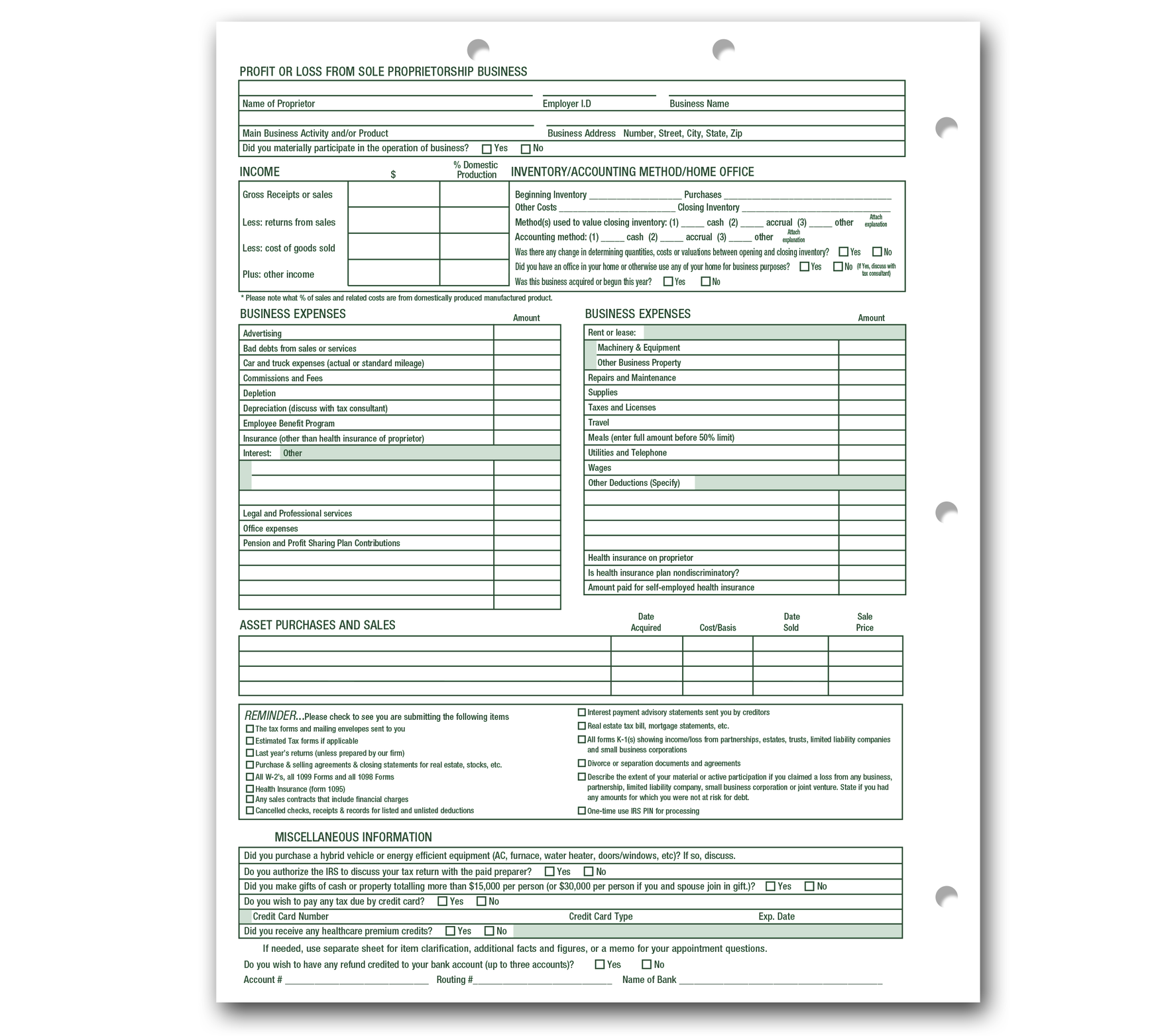

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Can I Deduct My Health Care Costs On My Tax Return Nyc Tax Accounting Services George Dimov Cpa

Taxes Holdenaccountingservices Com United States

Every Landlord S Tax Deduction Guide Fishman J D Stephen

2021 Last Minute Business Income Tax Deductions

Tax Deduction Recorder 175 Pkg Item 01 700

P60 Form Tax Paycheck Payroll Multi Purpose Text Income Tax Form Png Pngwing

Accounting Services Marcum Llp Accountants And Advisors

Investment Expenses What S Tax Deductible Charles Schwab

25 Small Business Tax Deduction You Should Know In 2022

Can I Deduct Accounting Fees Larry Bertsch Cpa In Las Vegas

Verimax Tax And Accounting Services Tax Preparation Service In Charlotte Nc

Unexpected Tax Bills For Simple Trusts After Tax Reform

16 Amazing Tax Deductions For Independent Contractors Next

Deducting Home Office Expenses Journal Of Accountancy

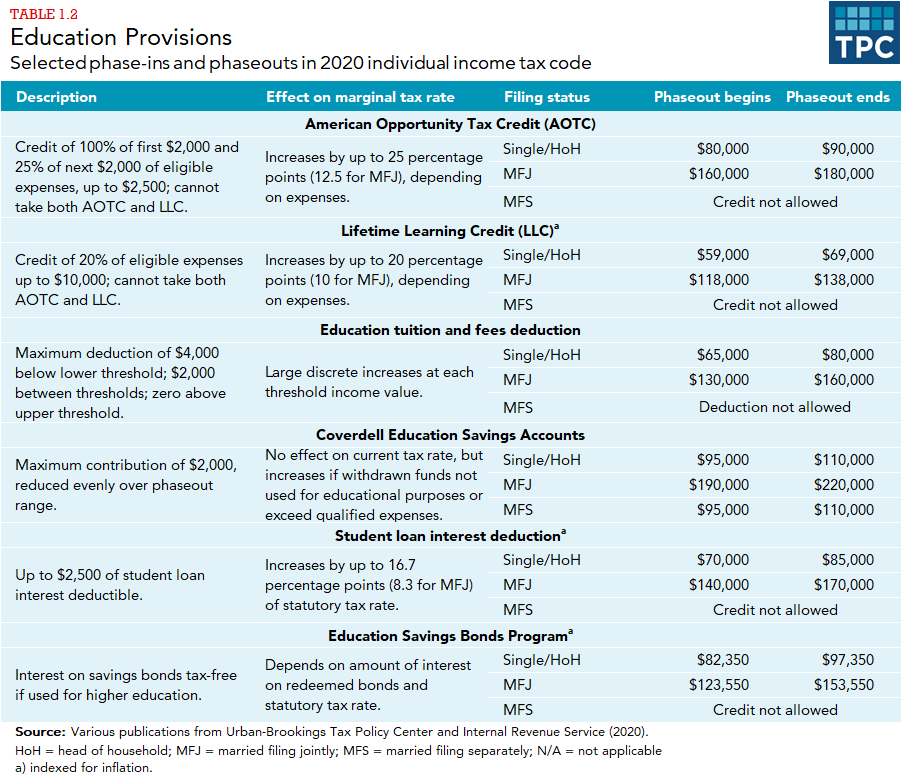

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

21 Small Business Tax Deductions You Need To Know Nerdwallet